Auto Insurance Cincinnati Things To Know Before You Buy

What Does Boat Insurance Cincinnati Do?

Table of ContentsThe Only Guide to Motorcycle Insurance CincinnatiMotorcycle Insurance Cincinnati Can Be Fun For EveryoneAuto Insurance Cincinnati - TruthsRumored Buzz on Cincinnati Insurance CompanyThe smart Trick of Boat Insurance Cincinnati That Nobody is Talking AboutThe Of Boat Insurance Cincinnati

Car insurance policy has you covered when crashes happen. Let's state you go to a traffic signal and a distracted chauffeur falls short to stop in time and also strikes the rear of your car. If you really did not have car insurance coverage, you would certainly have to pay of pocket for any damages to the vehicle.Auto insurance functions by providing monetary defense for you in case of a mishap or burglary. Vehicle insurance policy premiums take an appearance at several variables based upon you, your car and also your driving background. Some of which might consist of: Driving record Simply placed, the far better your driving document, the reduced your premium.

These products and solutions are supplied to Wisconsin residents. Auto insurance safeguards not only you, however likewise travelers, other chauffeurs, as well as pedestrians. It also offers coverage for damages to your car and other individuals's home. How much insurance and also what type of protections you require will certainly rely on your scenario.

The Ultimate Guide To Cincinnati Insurance Company

It does not spend for physical injury you may sustain. Residential property damage, This insurance coverage shields you if you are at mistake for damages to an additional person's residential or commercial property, such as a cars and truck, its materials, or other residential property you harm in an accident such as a garage, residence, fencing, or trailer. Medical settlements, Medical payments protection pays for essential treatment for you or others covered by your plan arising from an accident.

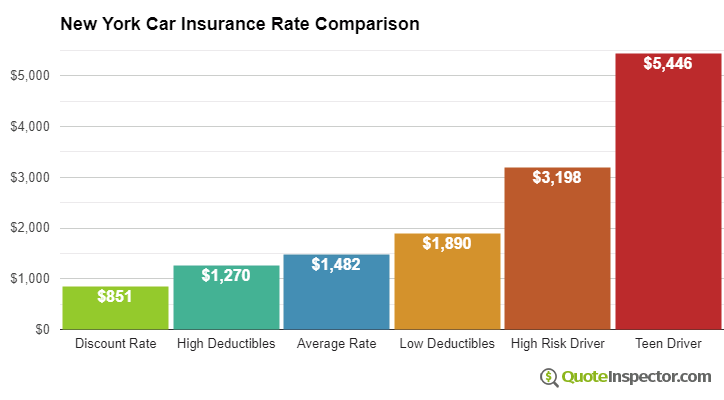

A greater insurance deductible decreases the possibility that your standing with your insurance policy firm will certainly be affected. If you have a reduced insurance deductible which creates you to send a variety of tiny cases, your costs will likely increaseor your coverage might even be terminated. Your capability to pay the deductible is a crucial factor to consider when selecting a degree that is right for you.

The smart Trick of Boat Insurance Cincinnati That Nobody is Discussing

This discount applies if the household has actually not had any at-fault crashes within the last three years. This discount rate program benefits those that have been guaranteed by WEA Residential property & Casualty Insurance policy Firm for 3 or more years. This discount rate uses when a participant restores his or her policy. For drivers of any type of age, a 15% discount uses discover this info here if the policyholder is mishap cost-free for a period of 7 years.

At Member Advantages, you select where you want to get your lorry fixed. Unlike lots of other insurer, we do not tell you where to get your vehicle repaired. It's "your Choice." We will forgo one speeding up ticket or small relocating violation per insured house. Commonly, the only time you listen to from your insurer is when your premium schedules.

We perform periodic plan evaluates that aid you reveal just how changes in your individual life might influence your insurance coverage requires. We appreciate your commitment. If you are in an accident and also you have been guaranteed with us for 5 or even more years with no previous crashes or tickets in the house, we will forgo the mishap surcharge.

Getting My Boat Insurance Cincinnati To Work

If you wound someone with your automobile, you can be taken legal action against for a whole lot of cash. The amount of Obligation protection you bring ought to be high sufficient to secure your properties in the occasion of a crash. Most professionals advise a limit of at least $100,000/$300,000, however that may not be enough.

If you have a million-dollar home, you might shed it in a lawsuit if your insurance policy coverage is not enough. You can get added coverage with a Personal Umbrella or Personal Excess Responsibility policy (auto insurance Cincinnati). The greater the value of your possessions, the extra you stand to shed, so you need to buy obligation insurance policy ideal to the worth of your properties.

How Motorcycle Insurance Cincinnati can Save You Time, Stress, and Money.

You do not have to determine just how much to acquire that depends upon the car(s) you guarantee. You do require to make a decision whether to purchase it and just how big a deductible to take. The higher the insurance deductible, the lower your premium will certainly be. Deductibles typically range from $250 to $1,000.

Comprehensive protection is normally offered together with Accident, and the two are commonly described with each other as Physical Damages insurance coverage. If the auto is rented or financed, the leasing company or loan provider may require you to have Physical Damages insurance coverage, although the state law might not need it. Covers the expense of treatment for you as well as your travelers in case of an accident.

How Cincinnati Insurance Company can Save You Time, Stress, and Money.

If you pick a $2,000 Medical Cost Limitation, each traveler will certainly have up to $2,000 protection for clinical insurance claims resulting from a crash in your lorry. If you are associated with an accident and also the various other driver is at fault however has insufficient or no insurance policy, this covers the void in between your costs and also the various other motorist's protection, as much as the limitations of your coverage.